Best Payment Gateway Providers for 2023

A payment gateway is a tech backend solution that facilitates the payment process for online businesses. Important, right?

Even though the use of payment gateway services has become more prevalent in recent years due to an increase in the usage of virtual currency, it is quite unimaginable for today's business to work properly without one. It has been like that for a couple of years already.

Examples of well-known payment gateways include Stripe, PayPal, Payoneer, etc. Or are these payment service providers (PSP) payment processors?

Payment Gateways vs. Payment Service Providers (PSP)

Let’s explain the terminology first. The distinction between a payment processor and a payment gateway is that the former is the service provider that facilitates the transaction, whereas the latter is the communication channel in charge of safely delivering the payment data to the networks for credit cards and the payment processor.

When we say Stripe, for example, we think of it as a payment processor that ensures transaction data is collected and securely managed through the payment gateway they offer. Here, however, we’ll talk about gateways, i.e., what’s under the hood making Stripe’s offer so good.

Now that we’ve explained the terminology let’s dig a bit deeper.

How Do Payment Gateways Work?

- Once the customer adds the items they would like to purchase, they proceed toward the payment stage, where all the payment information is provided.

- The payment information (e.g., card details) is then encrypted and sent to the payment gateway.

- The gateway transfers the card details to the issuing institution, which will then authorize the payment.

- Once the issuing authority performs the required checks, it sends back a message stating whether the payment was approved or not to the payment gateway.

- The payment gateway then relays the same information to the merchant, based on which the user will either see a payment confirmation page if payment was successful or an error page if it was the opposite.

A lot of back and forth, right? Typically, this entire process only takes a few seconds at most.

Selecting a Payment Gateway

While trying to choose one, you need to consider the following and select the one that fits your needs and use case best.

🔑Encryption. Encryption is vital as the information passed on to these gateways is extremely sensitive. To minimize risks and avoid fraud, you must ensure that your chosen payment gateway passes all the encryption standards.

📍Location. If you have an online store in multiple countries, location is essential. Not all payment gateways provide services in every country. One such example would be Razorpay, which is only accessible to customers in India.

💰Cost. When choosing a gateway, one of the first questions is, “how much does it cost?”. All gateways have their costs and fees. Some charge fixed rates, while others charge based on the value of transactions. Moreover, additional currency conversion charges and other services would be added to the total.

Let’s talk about the available solutions now.

Payment Gateways in 2023

Let’s discuss some of the most well-liked solutions we've used rather than ranking our choices as the best…and leave the decision to you.

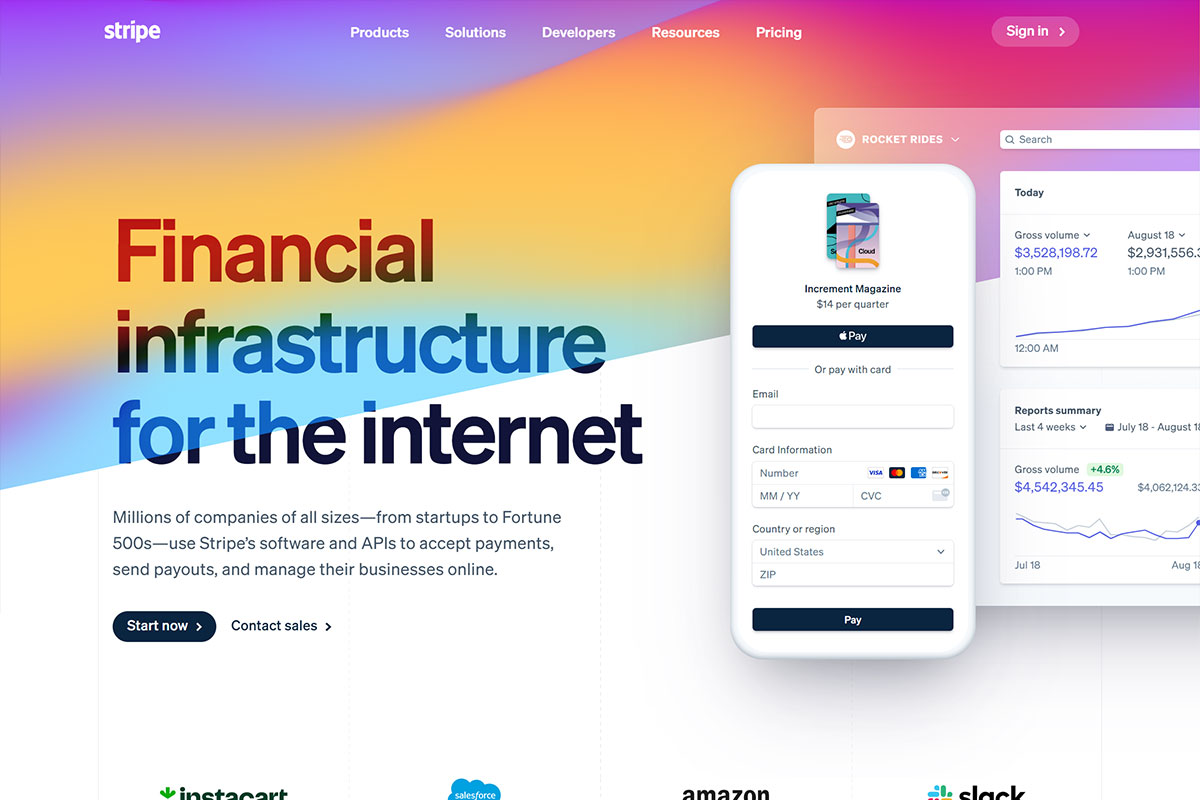

Stripe

Stripe is one of the most popular and widely used gateways. It's famous for its popularity and its ease of use. It allows businesses to receive payments via their website or mobile application.

With Stripe, you get access to a number of APIs to make payment integration for your web application as seamless as possible, with support available for numerous languages such as Go, Ruby, Python, Node, etc. Furthermore, Stripe also boasts support for over a hundred currencies and provides you with convenient features such as subscriptions and one-click checkout.

Stripe has made integration as easy as possible with the help of various libraries and web elements. In addition to that, you also get a low-code solution known as Checkout, which is a prebuilt checkout page. If you’d rather not make a storefront and just need to collect payments by sharing a link, Stripe has got you covered there as well with their Payment Links option.

If you are looking for a quick payment integration to allow card-based payments, Stripe is one of the best options out there. However, to avail the benefits of the more advanced features provided by the platform, you will require some technical knowledge.

💰Cost. With Stripe, you pay as you go. Setup is free, and there is no monthly fee. Transaction costs might differ based on the location. For example, for Norwegian cards, it is 2.4% and a small additional charge, whereas, for international cards, it is 2.9% and a small additional fee per transaction.

To integrate Stripe with Crystallize, check out our Stripe integration guide.

Adyen

Since its inception in 2006, Adyen has grown tremendously over the years. Its clientele includes companies like eBay, Mango, Spotify, and Uber. It is an omnichannel payment system, meaning every transaction is unified in a single platform. Adyen also provides you with features such as fraud detection to minimize the risk associated with a transaction.

With Adyen, you get access to over 250 payment methods and support for several locations in Oceania, Asia, Africa, the Middle East, America, and Europe. What’s even more interesting is that you also get an insight into customer behavior. Isn’t that just amazing?

Integration has been made as easy as possible, as Adyen has various plugins available. There is support for many languages, including JavaScript, Go, Ruby, Python, etc. The documentation is also highly comprehensive and contains detailed guides for integrating the service into your application.

💰Cost. There is no setup fee charged for Adyen. Thereon, a minimal fixed processing fee is charged in addition to a fee based on the chosen payment method for each transaction.

Vipps

Vipps is Norway’s largest payment provider. Developed in 2015 by DNB, the application reached one million users within the first six months.

Transactions with Vipps are incredibly convenient. All a user needs is a phone number. However, unlike Stripe or Adyen, this payment provider only supports users in one country, i.e., Norway. All transactions take place via a mobile phone, so having a Norwegian phone number is a prerequisite. In addition to providing a way to send and receive money, Vipps also has a login API. If your customer base is Norway, you can use Vipps as a payment provider and as a way to authenticate users.

💰Cost. Vipps does not charge any monthly fees. A processing fee is charged for each transaction. The login service, on the other hand, is free of charge. A more detailed overview of this can be found on their pricing page.

Our HQ is in Norway, so of course, we had to do the integration for Vipps 😉

Klarna

Klarna's buy now, pay later strategy has made it one of the most prominent payment providers in Europe. First launched in Sweden, Klarna steadily gained popularity in other Nordic countries. Their current clientele includes big names such as Adidas, Bvlgari, Dyson, etc.

Klarna differs from its competitors. With Klarna, merchants get payment upfront, whereas users can choose to pay in installments. This leads to an increase in sales conversion.

💰Cost. Like the payment providers mentioned above, Klarna also charges based on the transaction. Despite its several payment options, there is no need to worry about hidden charges at all.

Razorpay

If you are an Indian user, chances are you have heard of Razorpay. It is one of the most popular payment gateways in the country, with support for various payment methods, including cards, UPI, and different mobile wallets.

On top of that, Razorpay has a very developer-friendly API. Integrations have been made as smooth as possible by providing SDKs, plugins, and sample applications for multiple languages, including JavaScript, PHP, Ruby, Go, Java, Python, etc. Additionally, a Postman collection is also provided so you can play around with the API easily.

One downside of using this provider is that it is only available in India for now.

At Crystallize, we have made it even easier to integrate Razorpay. An example of this can be seen in our latest Remix boilerplate.

Braintree

Used by prominent brands like GitHub, Airbnb, Krispy Kreme, Skyscanner, etc. Braintree is one of the most trusted payment solutions out there and is a PayPal service. There is support for most of the commonly known payment methods like Apple Pay, Google Pay, credit cards, Samsung Pay, PayPal, Venmo, and even some local banks based on your location.

One of the major risks associated with online payments is fraud. To mitigate this, Braintree also provides tools such as 3D Secure two as well as real-time evaluation and detection checks before the payment is fully processed. Isn’t that amazing?

There are multiple ways to integrate this solution into your application. The fastest one is their Drop-in UI which is a readymade payment UI that is secure. Examples of widely used programming languages, including Ruby, PHP, .NET, Node.js, and Python, can be found on GitHub.

💰Cost. Similar to some of the payment solutions above, there is no monthly or hidden fee. Braintree charges based on the payment method chosen for a transaction and your location. Example: If you’re in the UK, the transaction fee is 1.9% + £0.20 per transaction.

Montonio

Based in Estonia, Montonio is an up-and-coming payment provider targeting the European market. Like Klarna, this solution also provides the option to ‘buy now, pay later’ to its users in addition to taking care of deliveries as well as refunds.

One of the benefits of using this service is that it provides support for most of the major banks in the Baltics, Poland, and Finland through payment links,

Integrating with Montonio is made simple through the availability of a plethora of plugins. In addition to the plugins, you can also use the API to have more control over the integration.

💰Cost. If a user chooses to pay using the payment links mentioned above, Montonio charges €0.05 + VAT for each transaction which is relatively cheaper than payments made via card.

SquareUp

SquareUp is a powerful payment solution. With SquareUp, you get access to staff solutions (payroll, team management, etc.), customer solutions (analyzing customer behavior, marketing, etc.), and so much more. Similar to Adyen, this is also an omnichannel payment system, where every transaction that takes place is unified in a single platform.

Furthermore, there are APIs for every stage, from payments to delivery, to make your workflow as convenient as possible. This includes APIs for orders, invoices, subscriptions, inventory, merchants, locations, disputes, etc. There is even a gift card API!

Overwhelmed by the number of APIs? No need to worry as SquareUp also makes the developer experience extremely smooth with its API Explorer, where you can play around with all their APIs to see the queries as well as the response. Additionally, there are SDKs available for several programming languages, such as Ruby, Java, .Net, Node.js, PHP, and Python.

💰Cost. There is no setup or monthly fee you need to pay. Once you make a payment,SquareUp’s processing fee is just 2.9% + 30¢ per online transaction. Discounted processing is also available on the paid Premium plan.

Which One to Choose?

There is no one solution for use cases. The best recommendation we can make is to weigh payment gateway options against your company's or project's goals and budget before making a decision.