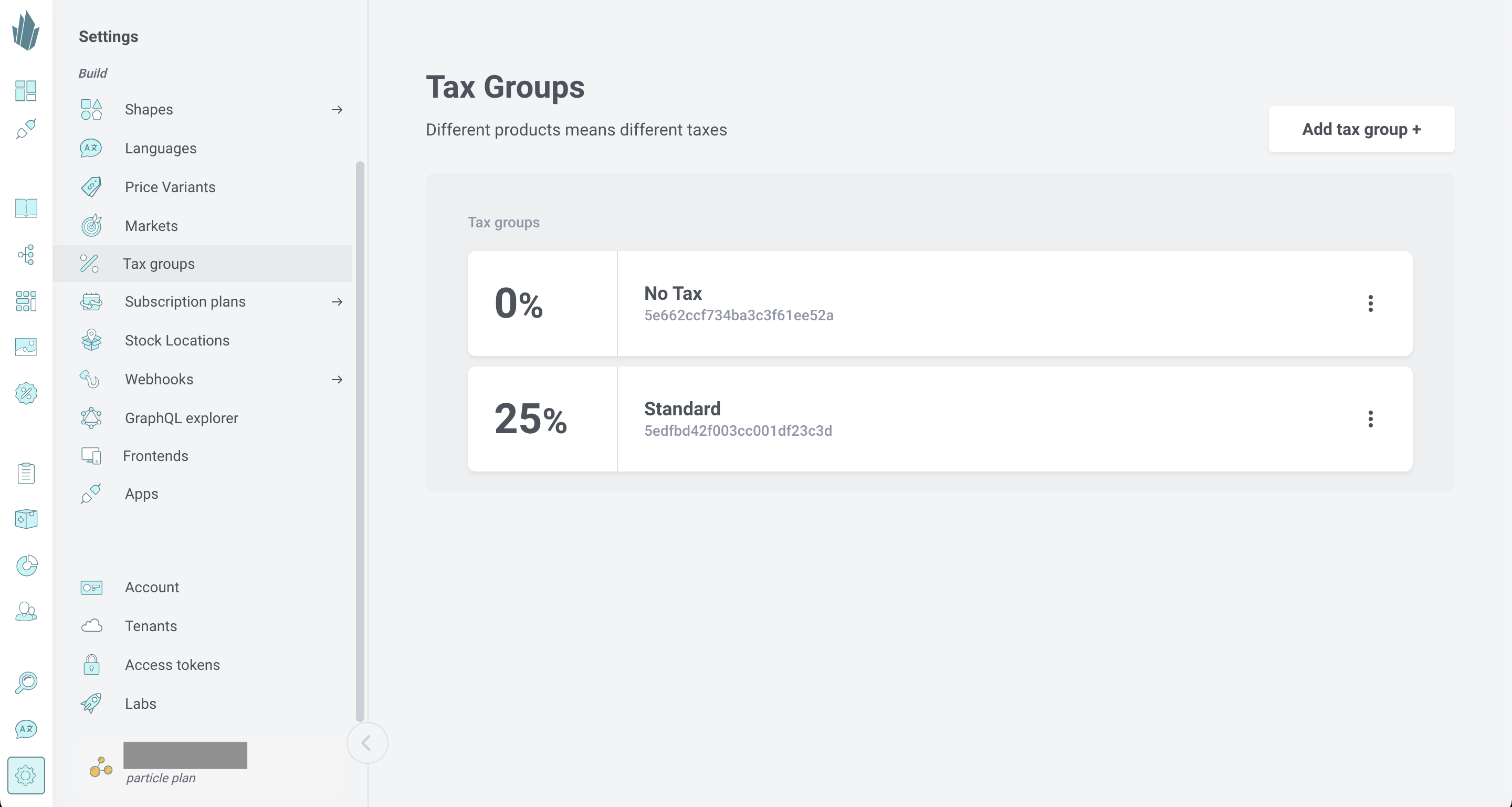

Tax Groups

Tax groups (sometimes called VAT groups) allow you to categorize products by tax rules. In Crystallize, you can define any number of tax groups and assign one group per product.

Important Considerations

- One tax group per product — You can’t assign multiple tax groups to a single product.

- Tax groups are not market-aware — The tax group applies globally; it doesn’t vary by market or region.

- When to use external tax services — If you need dynamic, locale-aware tax logic (especially for multiple countries or U.S. states), use a dedicated tax service like Octobat, Avalara, or TaxJar / Stripe.

- Custom logic possible — You can override or supplement tax behavior using the Shop API.

Step-by-Step: Adding a Tax Group

- Go to Settings → Tax groups.

- Click Add tax group.

- Enter a name and any relevant settings.

- Use the action menu (…) next to each group to edit or delete it.

When to Use Tax Groups vs. External Services

If your business only operates within one country or a region with simple tax rules, Crystallize’s tax groups may suffice. But for multi-jurisdiction tax compliance, region-specific rates, or tax remittance, you’ll want to integrate with a tax engine (which can work in concert with Crystallize).